Automatic exchange of info to unearth black money: Nirmala Sitharaman

text_fieldsNew Delhi: Extending full support to the automatic exchange of tax and banking information, India on Monday said it will help in unearthing black money stashed abroad and bringing it back.

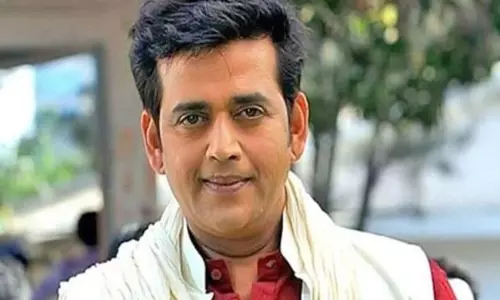

Intervening at the meeting of G20 Finance Ministers in Cairns (Australia), Minister of State for Finance Nirmala Sitharaman said 46 countries, including India, have agreed for a common time to exchange information automatically by 2017.

"We call upon everybody to join us," she said.

The G20, at the end of their two ministerial meeting on Sunday, had decided to put in place a mechanism for automatic exchange of tax information between various countries by 2017.

The new framework would mark a significant forward movement from the current practice of information exchange mostly on the basis of requests and only in the cases of suspected tax evasion or other financial crimes.

"This would be the key to prevent international tax evasion and avoidance and would be instrumental in getting information about unaccounted money stashed abroad and ultimately bringing it back," Sitharaman added.

India has been at the forefront in raising the issues concerning tax avoidance and automatic exchange of information with a view to curbing tax evasion.

The new global standard, as formulated by Paris-based Organisation for Economic Cooperation and Development (OECD) in July, would facilitate a "systematic and periodic transmission of bulk taxpayer information by the source country of income to the country of residence of the taxpayer concerning various categories of income or asset information".

Sitharaman urged upon the countries to make necessary changes in their domestic laws so as to enable them to provide the same level of information to other countries on a reciprocal basis.