Petronet disfavoured $2.5 bn LNG deal in April; signs non-binding MoU now

text_fieldsNew Delhi: The Petronet LNG Board had just six months back disfavoured a $2.5 billion deal to buy 18 per cent stake in US firm Tellurian Inc's proposed Driftwood LNG terminal, and import 5 million tonnes LNG a year from it for 40 years as the gas was available in plenty and no longer required equity investments, sources said.

Petronet on September 21 signed a Memorandum of Understanding (MoU) with Tellurian "wherein Petronet and its affiliates intend to negotiate the purchase of up to five million tonnes per annum (5 mtpa) of liquefied natural gas (LNG) from Driftwood, concurrent with its equity investment, which remains subject to further due diligence and approval of its board of directors," according to a joint statement.

The Indian firm on Sunday evening in a regulatory filing said it had signed a "non-binding" MoU with Tellurian at Houston, USA. "The process is subject to due diligence and approval of respective Board of Directors," it had said.

Officials privy to board deliberations said the issue was discussed at the company's board meeting in April/May and members felt that the company should not go ahead with the deal due to changing global gas market dynamics, where the fuel is available in abundance at rock bottom prices.

Locking imports for 40 years together with an equity investment in the LNG terminal was not favoured, they said, adding Petronet's promoters, including state-owned gas utility GAIL India Ltd, refiner Indian Oil Corp (IOC) and Oil and Natural Gas Corp (ONGC), were all against the deal.

Company managing director and CEO Prabhat Singh neither answered calls and nor replied to text messages sent for comments.

Petronet is a firm promoted by GAIL, IOC, ONGC and Bharat Petroleum Corp Ltd (BPCL), and Secretary to Ministry of Petroleum and Natural Gas, Government of India, is its chairman.

The officials said the deal with Tellurian is far from closed and will require negotiations.

The deal will go through if the government was to push for it, they added.

If concluded, this would be the first long-term LNG import contract signed since the Narendra Modi government came to power in 2014. All the previous deals - 7.5 million tonnes with Qatar, 1.44 million tonnes with Australia, 2.5 million with Russia and 5.8 million tonnes with the US - were all signed during the Congress-led UPA regime.

Petronet had first signed a broader agreement in February.

The sources said India is looking at reopening pricing of previously entered LNG import deals with the US and Petronet board was of the majority view that locking in quantities and price for 40 years was not a good option at this point of time.

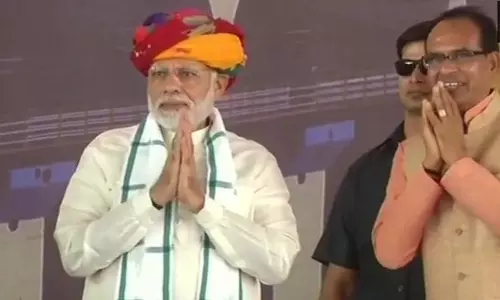

Petronet signed the MoU on sidelines of Prime Minister Narendra Modi's visit to Houston.

GAIL had in 2011 signed a 20-year deal to buy 5.8 million tonnes per year of US LNG, split between Dominion Energy Inc's Cove Point plant and Cheniere Energy Inc's Sabine Pass facility in Louisiana.

That deal prices of LNG were at 115 per cent of prevailing Henry Hub price of gas plus $5.05 per million British thermal unit. The landed price in India comes to $9-10 per mmBtu against LNG being available in the spot or current market for USD 5-6.

GAIL wants to renegotiate the 2011 sales and purchase agreement (SPA) with Cheniere Energy for import of 3.5 million tonnes of LNG annually, with yearly fixed fees of $548 million and a term of 20 years.

Besides the 3.5 million tonnes per annum of LNG from Houston-based Cheniere, GAIL has booked 2.3 million tonnes a year capacity at Dominion's Cove Point liquefaction facility.

In the statement, Tellurian and Petronet had stated that they will endeavour to finalise the transaction agreements by March 31, 2020. Petronet's regulatory filing, however, did not mention of this deadline.