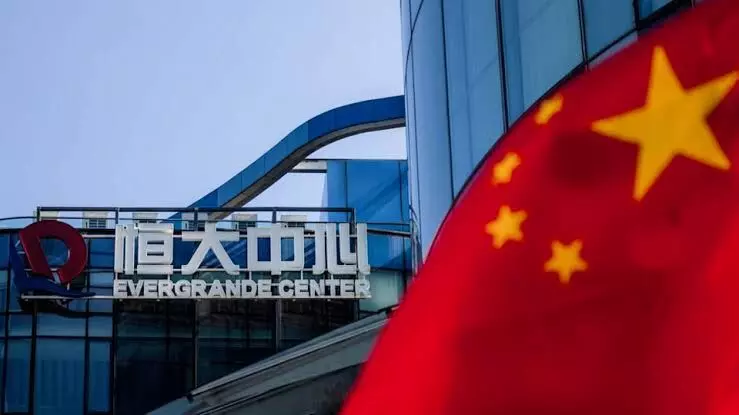

Evergrande on the brink of another default; Chinese debt crisis looms

text_fieldsChinese real-estate developer Evergrande is once more looking at a possible loan default of approximately $148 million on its April 2022, 2023 and 2024 bonds, which ends on Wednesday. ALthough Evergrande has not defaulted as of yet despite looming $300 billion in liabilities, a default would trigger cross-default provisions for other Evergrande dollar bonds, exacerbating a debt crisis looming over the world's second-largest economy.

The Chinese government had assured the international community that the crisis affecting Evergrande would be dealt with as news of the liabilities hit markets, causing a drop in the September-October session. The U.S. Federal Reserve warning on Tuesday that China's troubled property sector could pose global risks, as it owes $19 billion in international market bonds.

To help shore up the sinking developer, Chinese state-owned firms and property-developers are being encouraged to purchase Evergrande assets. Rising concerns about the developers' woes spreading to other sectors was visible on Wednesday as the spread, or risk premium, between lower risk, investment grade Chinese firms and U.S. Treasuries widened to a more than five-month high.